Take the time to learn the pluses and minuses of COBRA health insurance, how much it costs, how to qualify, deadlines involved, alternatives to consider, and more by reading my newest article for Forbes Advisor, available here.

August 30, 2022

Understanding COBRA insurance

Worried about health care insurance coverage after you quit or lose your job? Fortunately, you can take advantage of COBRA insurance benefits, which allow you to continue your employer-based insurance coverage if you qualify.

August 23, 2022

Garden glow know-how

Want a yard and garden that brightens up your disposition and spotlights safety? Consider landscape lighting on your grounds that can add instant aesthetic appeal and valuable illumination to deter trespassers.

Consider that proper outdoor lighting is a good idea to protect your home against theft while also creating an ambiance that radiates warmth and joy for the people living inside. And research suggests mental health benefits can be gained when you have a good yard design.

Get helpful tips on how to illuminate your grounds safely and effectively by reading my latest piece for CTW Features, available here.

August 11, 2022

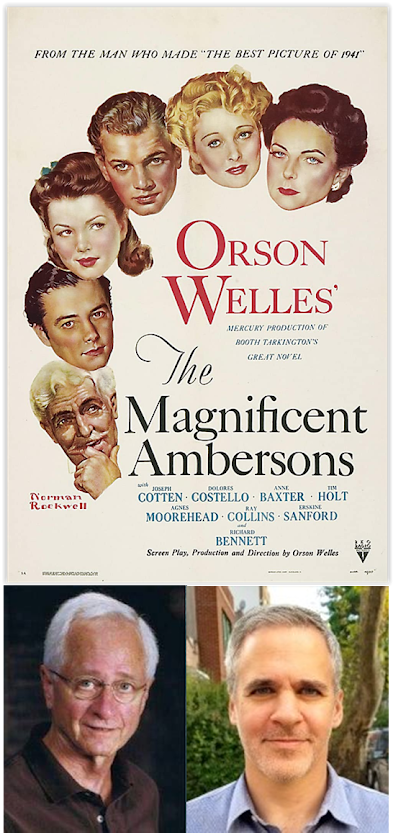

Cineversary podcast rediscovers the magnificence of the Ambersons

|

| James Naremore and Joshua Grossberg |

To listen to this episode, click here or click the "play" button on the embedded streaming player below. Or, you can stream, download, or subscribe to Cineversary wherever you get your podcasts, including Apple Podcasts, Spotify, Stitcher, Castbox, Google Podcasts, Pocket Casts, PodBean, RadioPublic, and Overcast.

Learn more about the Cineversary podcast at anchor.fm/cineversary, and email show comments or suggestions to cineversegroup@gmail.com.

August 8, 2022

Know which drivers should be listed on your auto insurance policy

Choosing which drivers must be listed on your car insurance policy is quite important and, fortunately, easy to do.

Your auto insurance premium is partially determined by the drivers listed on your policy. While your insurer looks at more than a dozen factors that affect your insurance rates, any drivers (and their driving record) listed on your policy will absolutely push your premium up or down. The big question is, who exactly has to be listed on your policy, and how will that impact your premium? While a fully licensed teen driver certainly needs to be listed, what about a teen with a learning permit, a parent living with you, or a neighbor who borrows your truck to move?

Your auto insurance premium is partially determined by the drivers listed on your policy. While your insurer looks at more than a dozen factors that affect your insurance rates, any drivers (and their driving record) listed on your policy will absolutely push your premium up or down. The big question is, who exactly has to be listed on your policy, and how will that impact your premium? While a fully licensed teen driver certainly needs to be listed, what about a teen with a learning permit, a parent living with you, or a neighbor who borrows your truck to move?

Get helpful answers to these and other questions by reading my latest story for Insure.com, available here.

August 1, 2022

Housing market halftime is over: Here's what the 3rd quarter will look like

The third quarter of the year, which kicked off a month ago, brought a few surprises to the market – including a slight dip in mortgage rates and signs of falling home sales.

But the near-term future looks relatively predictable to many pros, who foresee slightly lower or stabilized mortgage rates, relatively high home prices, and lingering supply issues despite more inventory expected. Industry insiders are also mindful of a possible recession, which could alter prospects for the rest of 2022.

Curious what housing drifts are anticipated by those in the know? Eager to learn if buying or selling is a smart move between now and the end of September? Read my newest piece for Bankrate (available here) for valuable insights and helpful recommendations offered by different industry experts.

But the near-term future looks relatively predictable to many pros, who foresee slightly lower or stabilized mortgage rates, relatively high home prices, and lingering supply issues despite more inventory expected. Industry insiders are also mindful of a possible recession, which could alter prospects for the rest of 2022.

Curious what housing drifts are anticipated by those in the know? Eager to learn if buying or selling is a smart move between now and the end of September? Read my newest piece for Bankrate (available here) for valuable insights and helpful recommendations offered by different industry experts.

Subscribe to:

Posts (Atom)